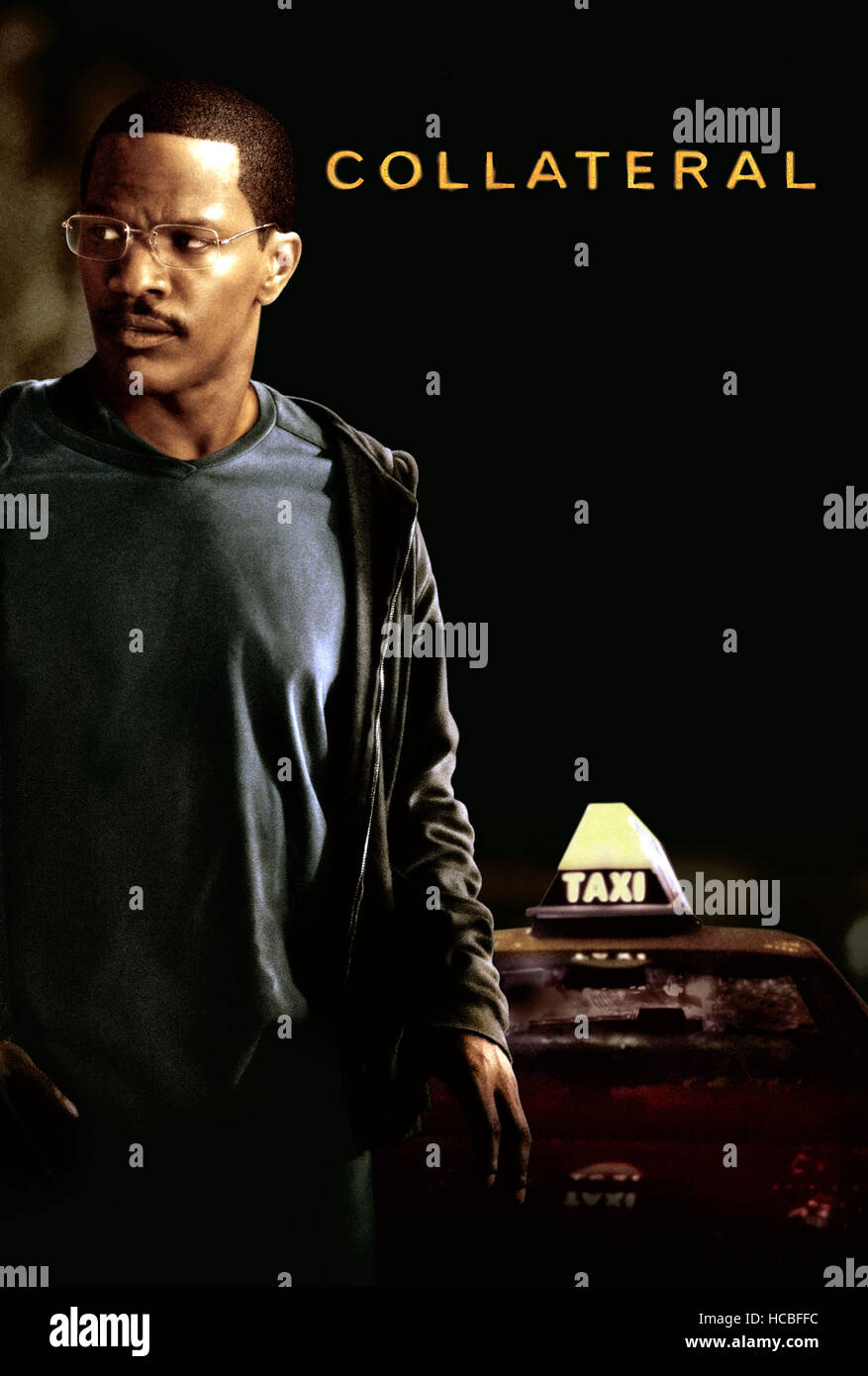

Collateral Jamie Foxx

In the ever-evolving world of finance, the concept of collateral has always been a cornerstone of lending and investment strategies. One of the most intriguing figures in this realm is Jamie Foxx, an actor known for his versatility and talent. However, Jamie Foxx's involvement in the financial world, particularly in the context of collateral, adds an intriguing layer to his public persona. This post delves into the significance of collateral, its various forms, and how figures like Jamie Foxx might leverage it in their financial endeavors.

Understanding Collateral

Collateral is an asset that a lender accepts as security for a loan. It serves as a guarantee that the borrower will repay the loan. If the borrower defaults, the lender can seize the collateral to recover the outstanding amount. Collateral can take many forms, including real estate, vehicles, stocks, bonds, and even cash. The type of collateral used often depends on the nature of the loan and the borrower's financial situation.

Types of Collateral

There are several types of collateral that can be used in financial transactions. Understanding these types can help individuals and businesses make informed decisions about their borrowing and lending activities.

- Real Estate: Properties such as homes, commercial buildings, and land are common forms of collateral. Real estate is often used for mortgages and business loans.

- Vehicles: Cars, trucks, and other vehicles can be used as collateral for auto loans and personal loans.

- Financial Assets: Stocks, bonds, and other financial instruments can serve as collateral for margin loans and securities-based lending.

- Cash: Cash deposits can be used as collateral for certain types of loans, such as savings-secured loans.

- Inventory: Businesses often use their inventory as collateral for inventory financing, which helps them manage cash flow and operational expenses.

Collateral Jamie Foxx and High-Net-Worth Individuals

For high-net-worth individuals like Jamie Foxx, collateral can play a crucial role in managing their financial portfolios. These individuals often have diverse assets that can be leveraged to secure loans for various purposes, such as investing in new ventures, purchasing property, or funding personal projects. Jamie Foxx, with his extensive career in entertainment, likely has a range of assets that can serve as collateral.

One of the key advantages of using collateral for high-net-worth individuals is the ability to access larger loan amounts at more favorable interest rates. Lenders are more willing to offer better terms when the loan is secured by valuable assets. This can be particularly beneficial for individuals like Jamie Foxx, who may have significant financial goals and require substantial funding.

Moreover, using collateral can help high-net-worth individuals maintain their liquidity. By leveraging their assets, they can avoid selling them to raise funds, which can be advantageous in maintaining their investment portfolios and avoiding potential capital gains taxes.

Strategies for Leveraging Collateral

Leveraging collateral effectively requires a strategic approach. Here are some key strategies that individuals like Jamie Foxx might consider:

- Diversify Collateral Types: Using a mix of collateral types can help mitigate risk and provide more flexibility in borrowing. For example, combining real estate with financial assets can offer a balanced approach to securing loans.

- Optimize Loan Terms: Negotiating favorable loan terms, such as lower interest rates and longer repayment periods, can make borrowing more manageable. High-net-worth individuals often have the leverage to negotiate better terms with lenders.

- Regularly Review Collateral Value: The value of collateral can fluctuate over time. Regularly reviewing and updating the value of collateral can help ensure that it remains sufficient to secure the loan.

- Consult Financial Advisors: Working with financial advisors can provide valuable insights and guidance on leveraging collateral effectively. Advisors can help individuals like Jamie Foxx develop strategies that align with their financial goals and risk tolerance.

💡 Note: It's important to remember that while collateral can provide significant benefits, it also comes with risks. Defaulting on a loan can result in the loss of the collateral, which can have serious financial consequences.

Case Studies: Jamie Foxx and Collateral

While specific details about Jamie Foxx's use of collateral are not publicly disclosed, it's reasonable to assume that he, like many high-net-worth individuals, leverages his assets to secure loans and investments. For instance, Jamie Foxx might use his real estate holdings as collateral for business ventures or personal projects. Similarly, his investments in stocks and bonds could serve as collateral for margin loans, allowing him to access additional funds without liquidating his assets.

Another example could be Jamie Foxx using his intellectual property, such as royalties from his films and music, as collateral. This type of collateral can be particularly valuable for individuals in the entertainment industry, as it provides a steady stream of income that can be used to secure loans.

Conclusion

Collateral plays a vital role in the financial strategies of individuals and businesses alike. For high-net-worth individuals like Jamie Foxx, leveraging collateral can provide access to larger loan amounts, favorable interest rates, and the ability to maintain liquidity. By diversifying collateral types, optimizing loan terms, and regularly reviewing collateral value, individuals can effectively manage their financial portfolios and achieve their goals. Understanding the various forms of collateral and their applications can help anyone make informed decisions about their borrowing and lending activities.

What is collateral and why is it important?

+Collateral is an asset that a lender accepts as security for a loan. It is important because it provides a guarantee that the borrower will repay the loan. If the borrower defaults, the lender can seize the collateral to recover the outstanding amount.

What types of assets can be used as collateral?

+Various types of assets can be used as collateral, including real estate, vehicles, financial assets like stocks and bonds, cash, and inventory. The choice of collateral depends on the nature of the loan and the borrower’s financial situation.

How does collateral benefit high-net-worth individuals?

+High-net-worth individuals can benefit from using collateral by accessing larger loan amounts at more favorable interest rates. It also helps them maintain liquidity by avoiding the need to sell assets to raise funds.

What strategies can be used to leverage collateral effectively?

+Effective strategies include diversifying collateral types, optimizing loan terms, regularly reviewing collateral value, and consulting with financial advisors to develop tailored strategies.

What are the risks associated with using collateral?

+The primary risk is that defaulting on a loan can result in the loss of the collateral, which can have serious financial consequences. It’s important to carefully consider the risks and benefits before using collateral.